6 Differences Between Savings Account and Current Account You Should know:-

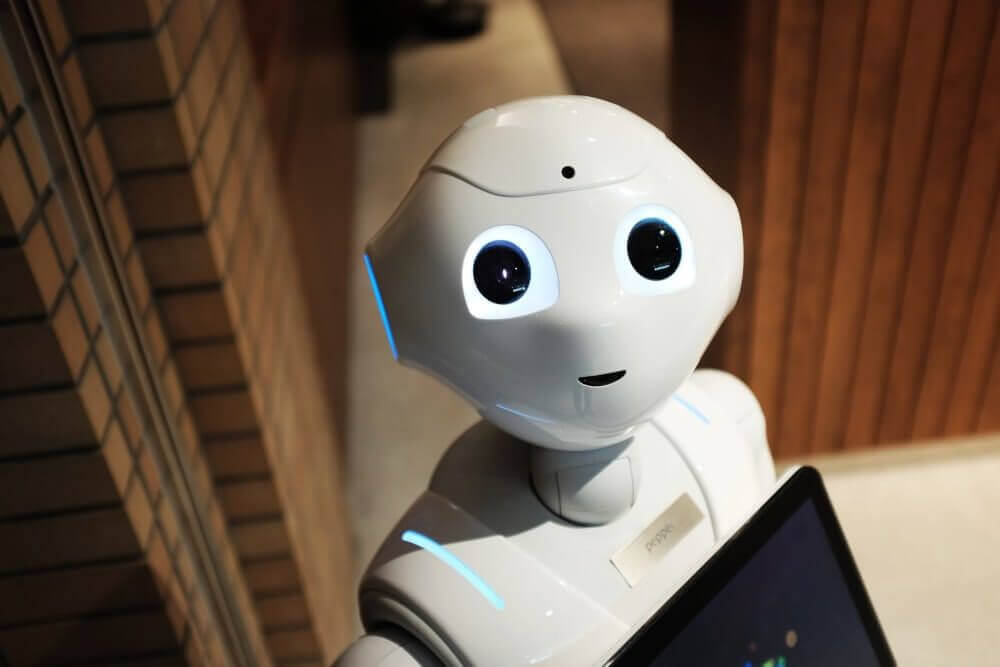

Current Account vs Savings Account

Savings account or current account- where to invest in? If this is something you are confused about, let us help you with a detailed understanding of both these types of accounts and the differences between them.

What is a Current Account?

A current account is a type of deposit account service given by the banks to individuals or institutions who intend to make a higher number of financial transactions on a day to day basis. This kind of account allows smooth, everyday transactions with a drawback of no interest acquiring ability. The following features further explain a current account-

While current accounts can be used by individuals to do everyday transactions, they are generally operated by businesses, trusts, associations, private/public entities for regular transactions

This type of account does not offer interest on the deposited amount; however, there are banks that have now started to offer interest on such type of accounts

A current account offers an overdraft facility

These accounts require one to maintain a higher minimum balance. If it is not maintained, a penalty is charged against it by deducting an amount from the user’s bank account. While this is the current account criteria for a major number of banks, Paytm Payments Bank does not require the user to maintain any minimum balance

Current accounts are of a continuing nature, which means, such accounts do not have any fixed tenure to be operated

KYC documents are required to open current accounts

There is no cap on the amount to be deposited and to be withdrawn; however, the account holder must have sufficient funds in his/her account for the transactions

Current accounts are further divided into different variants, offering businesses, entities, trusts and others the chance to choose the most appropriate one as per their requirements. These are-

Premium current account

Standard current account

Packaged current account

Foreign current account

As banks provide current account service with different current account variants, make sure to first finalize the bank you want to open your account with. Once done, thoroughly analyze all the current account variants according to their benefits, features, service before choosing the one!

As you are in the process of choosing a suitable bank that fulfils all your financial needs, you must note ignore the benefits of having a current account with Paytm Payments Bank. With Paytm Payments Bank current account, there is no mandate minimum balance requirement to operate the account and no processing fee is charged against any transactions. Upon opening the Paytm Payments Bank current account, you will also be given a free virtual debit card. To experience a fully digital banking experience, check out the detailed process to open a Paytm Payments Bank current account.

What is a Savings Account?

A savings account is a type of account that allows you to deposit money, and withdraw the same whenever required, all while earning interest on the deposited amount. The savings account features can be further explained as-

Savings accounts set no restriction on the amount deposited and the amount withdrawn; however, it is mandatory to keep the minimum balance in the account intact, otherwise, a penalty will be charged by deducting a particular amount from the account itself. As the major number of banks require the user to maintain a minimum balance, Paytm Payments Bank stands as an exception as does not require one to maintain any minimum balance to manage the account

A savings account can be operated as long as one wants, which means that there is no time limit to manage the account

Banks provide a fixed interest on the deposited amount to the account holder

A Savings account does not provide an overdraft facility

Saving account-holders are given debit cards and online banking facilities for regular transactions- for online, offline usages or at ATMs

Savings account restricts the number of transactions on a daily/monthly basis

Any Indian resident can open a Savings account; however, in the case of children and minors, parents/guardians are required to open & maintain the account

A savings account promotes saving habits

As savings accounts are one of the best ways to save your money without the need to carry the cash physically, you are given the opportunity to choose one among many types of savings account that suits the best of your requirements. Here is the list of savings account offered by a major number of banks that may vary from bank to bank-

Regular savings account

Salary savings account

Zero balance savings account

Children and minor savings account

Family savings account

Women’s savings account

Senior citizen savings account

All of the savings accounts variants differ as per the features, benefits and eligibility. For example- Senior citizen savings account is different from Children and Minor savings account, where the former account is meant for senior citizens only and the latter is for children below the age of 18. Similarly, a salary savings account is for salaried professionals whereas regular savings accounts can be opened by anyone. Thus, before choosing the one, be sure which bank and savings account variant will suit the best to your requirements.

When you choose a bank that fits perfectly with your banking requirements, make sure to explore all the benefits offered by the Paytm Payments Bank before proceeding further. The Paytm Payments Bank savings account offers a great number of benefits such as it involves only very few steps and has an entirely online account opening facility, there is no minimum balance requirement, users get a free virtual debit card along with 24*7 NEFT facility, and many other benefits.

0 Comments